Received an emailed list of the :most cited articles from Institutional Investor Journals. One of them caught my eye - "A Profile of Angel Investors" - published in the Journal of Private Equity. Haven't downloaded or read the article yet, but passing along in case you should care to...

Friday, December 11, 2009

Tuesday, December 1, 2009

Technology & Start-ups in the Sacramento Valley

I've been spending some time of late researching some of the organizations focused on technology and start-ups in the Sacramento Valley of late. Couple of interesting items to share:

Friday, November 27, 2009

Indulgences & Seigniorage

(Note: My thoughts on this aren't completely formed, but I felt it important to record as a start to the formalization process...)

Trolling through TED.com, I came across Jay Walker's presentation about his Library of Human Imagination. One of the artifacts he displayed during his talk was a Gutenberg Bible (about 90 seconds into the video) - the first substantial book to be mass produced using the printing press. Walker shared some insight about the reason behind the Catholic Church's reproduction of the bible - it wasn't so much for individuals to read the bible for themselves. Instead, the Gutenberg Bibles were reproduced so the Church could sell "indulgences" to the masses in order to raise money. The Church was struggling for cash, so in a sense, they financed their operations by issuing indulgences as currency, eventually printing millions of these and distributing them. In economic terms, this is known as "seignorage.")

The importance of seigniorage relative to other sources of government revenue differs markedly across countries. This paper tries to explain this regularity by studying a political model of tax reform. The model implies that countries with a more unstable and polarized political system will have more inefficient tax structures and, thus, will rely more heavily on seigniorage. This prediction of the model is tested on cross-sectional data for seventy countries. The authors find that, after controlling for other variables, political instability is positively associated with seigniorage. (my emphasis added)

The revenue consists of two parts, the first flowing from the willingness of the private sector to hold government financial liabilities (which we shall refer to as the real balance effect) and the second part from the taxation through inflation of the outstanding stock of real balances (the inflation tax effect.) Seigniorage is particularly attractive in economies where the traditional tax base is narrow and the costs of other forms of revenue collection are high. Moreover, in economies where the policy regime limits the portfolio of domestic financial assets available to the private sector, for example where there are limited possibilities for currency substitution, the potential for raising seigniorage revenue may be expected to be high. In addition, by exploiting the high adjustment costs faced by the private sector in such economies, revenue can be increased in the short-run as holders of money are temporarily forced off their equilibrium money demand functions and obliged to hold higher than desired money balances. The higher the costs of adjustment, the greater the short run value of the 'surprise' revenue.

- "the willingness of the private sector to hold government financial liabilities" - This refers to the issuance of US Treasury bills and bonds, in the current case, to finance deficit spending and debt.

- "taxation through inflation of the outstanding stock of real balances" - This refers to the decreased value of current debt due to inflationary effects from issuing new currency via seigniorage.

- "Seigniorage is particularly attractive in economies where the traditional tax base is narrow" - The United States faces the primary problem of a shrinking tax base. As this CBS News article from April 15, 2009 notes that an "astonishing 43.4 percent of Americans now pay zero or negative federal income taxes. The number of single or jointly-filing 'taxpayers' - the word must be applied sparingly - who pay no taxes or receive government handouts has reached 65.6 million, out of a total of 151 million.

- "the costs of other forms of revenue collection are high" - Other forms of revenue refers to income taxes or VATS. Certainly the US qualifies here.

- "economies where the policy regime limits the portfolio of domestic financial assets available to the private sector" - Congress (and the administration) is placing restrictions on securitization and considering other financial regulations under consideration. Using the housing market as example, it's the GSE's and the Federal reserve buying mortgage securities and loan portfolios, not the private sector as would be more efficient and economically sound.

- "revenue can be increased in the short-run ... The higher the costs of adjustment, the greater the short run value of the 'surprise' revenue." - The net result is a short-term bump in GDP to the long term detriment of the economy. That's what we saw in Q3, 2009.

Thursday, November 26, 2009

Sixth Sense Computing - Pranav Mistry on TED.com

Working from the in-laws basement this week and took a little retreat time to watch a few TED.com videos. If you want to get blown away by things like dialing cell phone by touching your fingers or seeing if you flight is on time by looking at your boarding pass, this is for you. (And I am really not doing this justice...) It's interesting that Mistry talks about bring the computing world into the objects world. His concept, to me at least, is bridging the gap between reality and the virtual world.

Sunday, November 8, 2009

Linked Data - Tim Berners-Lee

On the business side of life, there's been an active discussion this weekend about a new initiative led by the National Association of Realtors called the REALTORS® Property Resource (RPR) which is designed to provide a national property data exchange for agents to provide to clients. Yes, snooze-fest if you're not in the real estate industry. Our CEO does an excellent job describing the RPR project and its affect on the real estate industry.

On a personal level, the current industry discussion reminded me of a recent TED presentation by Tim Berners-Lee on Linked Data. As described on the TED website:

20 years ago, Tim Berners Lee invented the World Wide Web. For his next project, he's building a web for open, linked data that could do for numbers what the Web did for words, pictures, video: unlock our data and reframe the way we use it together.

Tuesday, October 27, 2009

Google's "Brain Drain"

Came across an interesting presentation today on The Business Insider that they posted back in September - "The Google Brain Drain Goes On And On."

Wednesday, October 21, 2009

"Too Big to Fail" & Charlie Rose

A recent issue of Fortune Magazine included a nice piece about Charlie Rose - "Why business loves Charlie Rose." I'm thankful for the article because it reminded me how much I enjoy his program so I've now set my DVR to record these episodes. Heck, if Warren Buffet watches it, I probably should.

Sunday, October 4, 2009

Greenspan on "This Week" with George Stephanopoulos

Was fortunate to flip on the TV the morning to catch Alan Greenspan on "This Week" with George Stephanopoulos. Here are some key statements during the interview with some additional explanation in parenthesis that I've added.

- The economy loses skills with elongated unemployment (When workers are not working and keeping up with new technology, new processes, and deploying new innovation, the skills of the worker deteriorate and fall further behind competition in the global economy.)

- Just after the financial crash, business (defined as economic participants) expected production and consumptions levels to fall off far more than they did. This spurred business to cut employment and production more than could have been economically supported. As a result, we're getting "horrendous" labor productivity numbers, meaning that the output per worker is declining.

- On unemployment, Greenspan noted that unless there are more than 100,000 new jobs a month, the unemployment rate will not improve.

- On government intervention and the stimulus package, the focus should continue to be on trying to get the economy going, but don't be counterproductive. As Greenspan stated, "we're in a recovery, his is what a recovery looks like. Looking back after this is over, we'll see ups and downs on a graph but look right through them right through them." The stimulus package is only 40% spent, so before considering a second package, the remainder (Evan Bayh on Fox News Sunday with Chris Wallace said he would have liked to have the stimulus go into effect sooner.)

- On GDP growth, Greenspan predicted 2.5% GDP growth in the third quarter and sees the numbers coming in higher than that once the estimates and revisions are completed. We're getting close to end of job loss, "but this is not the same as unemployment going done. We'll get to 10% barrier and stay there for a little while."

- On temporary actions, he feels that measures such as extended unemployment benefits are needed in the short term and is not a stimulus activity but may have some stimulus effects.

- On health care, the real problem exists in health care because of the huge fiscal hole as seen in Medicare. There is significant issuance of treasury bonds to finance the budget deficit. Historically we have kept our debt well below the borrowing capacity but that cushion is being tested which will affect LT interest rates. "Budget neutral is not adequate, weed to have address the long term."

Monday, August 10, 2009

Acquisition Price - FriendFeed/Facebook

I wish I was always this good... I guessed somewhere around $50 mln in an earlier post today about Facebook's acquisition of FriendFeed.

Friendfeed, Facebook (& Google?)

Friday, August 7, 2009

Rules for Changing Rules - Romer on TED.com

Friday, July 31, 2009

Google Profiles

Yep, there's lots and lots of places for an online profile, but I just set up my "Google Profile" and found it really easy and kind of fun. One aspect that I like is that Google Profiles aren't explicitly related to other applications such as the case with LinkedIn or Twitter. It's basically a simple landing page for you to show a little about yourself publicly then link to your contact info and other online places.

And given that it's hosted by Google, I'm sure that there's some SEO placement should someone be searching for you.

Here's my profile:

http://www.google.com/profiles/scottsambucci![]()

Monday, June 15, 2009

Even Google is Paranoid!

Given Google's new found paranoia, it gives me a certain amount of comfort to know that the laws of the free market and capitalism are still alive and well, even during a time where government programs and institutions are pushing a more socialist environment on the social side of our country's development.

Tuesday, May 5, 2009

NPR Interview from May 4

More fun stuff... NPR was looking for some to talk expertly about the national real estate market and the recent March numbers released from the National Association of REALTORS. Instead, they got stuck with me...

Here's a link to the short segment - Scott Sambucci on NPR.![]()

Tuesday, March 31, 2009

Quoted in Business Week article

This is kind of neat, and in the spirit of vanity (or more likely to help my self-esteem), thought I'd point out the article published on BusinessWeek.com this weekend where I was quoted:

Zip Codes with the Biggest Listing Price Gains by Prashant Gopal

We (meaning Altos Research) helped him out in his research by providing some real-time real estate market data.![]()

John Hussman on the Banking & Housing Markets

From John Hussman, of Hussman Funds, this article provides one of the most lucid descriptions of why the poorly constructed (I hate using the word "toxic"...) mortgage assets on bank balance sheets pose such as problem, and a clear set of solutions that would probably work if implemented. Hussman explains why allowing the banks to charge the negative assets to existing bank bondholders instead of using government cash infusions is a more natural plan, and why we're not even close to getting out of the woods in the housing market:

http://hussmanfunds.com/wmc/wmc090330.htm![]()

Sunday, March 29, 2009

Geithner on George Stephanopoulos

Watching the George Stephanopoulos show this morning (I'm not sure why, but....), but here are some notes from the interview:

- "People with ideas still want to come to the United States."

- "We need banks to take risk again - take a chance again on providing credit to that business..."

- After Stephanopoulos introduced Paul Krugman's comments that the Geithner plan is financial hocus pocus - "This is a conservative structure to have the private investor with the government sharing the risk."

- Stephanopoulos asked how much is left in TARP? - "$135 billion in uncommitted, including money coming back from banks that are stronger than thought and are not in need to the money originally allocated to them."

- On inflation that could be caused by printing money to finance the federal actions - "We'll never have hyperinflation. Increased money supply will not cause hyperinflation."

- Government has historically taken too long to assist in recovery, and pulled out of recovery mode too soon as soon as a glimmer of light was seen - Japan and Sweden in the 1990s, the United States Savings & Loans crisis, and the Great Depression.

- "Right now, we're about where we thought we'd be."

- "Damage from this situation is brutal, indiscriminate."

- "The market will not solve this. The error is not doing enough."

Wednesday, March 18, 2009

Milton Ezrati at the IMN Distressed Investment Summit

Milton Ezrati, Lead Economist at Lord Abbott, opened Information Management Network “Distressed Investment Summit: Credit Crunch Investment Strategies for Institutional Investors” conference on Monday. From his viewpoint, the market is running on emotion, which is covering up current market fundamentals. And the market ran on emotion over the last couple of years, which previously covered up really bad fundamentals. But the markets have over-reacted and are pricing assets to fear instead of to value. And the markets are slowly recovering from the emotion-based marking. Got all that?

Ezrati illustrated his point of view with a few examples:

- The TED Spread: Has historically bubbled around 25-30 basis points. It rose to 460 basis points in November 2008 and has since dropped down to 100 basis points - still not back to normal, but recovering.

- Credit Spreads: Junk bonds, which normally trade around 500-600 basis points, reached 2100 basis points but have fallen to 1500-1700 basis points.

- Merrill Lynch: In their sale to Bank of America, mortgage assets were priced at $0.22/$1, indicating that 78% of assets are worthless; yet 60% of sub-prime borrowers are current (and this doesn’t even count the intrinsic value of the properties themselves…)

- There was no bank deposit insurance then.

- There was no unemployment insurance then.

- Unemployment rose to 30% during the Depression, versus 8.1% now

- 9000 banks went bust during the Depression, versus 40 banks now.

- Worker Productivity rose in Q4-2008, even with the massive layoffs in the economy. (Those numbers have since been revised to show a -0.4% downturn in productivity, but given the sharp increase in unemployment in Q4, this value seems to indicate that productivity is still ahead of employment declines.)

- Personal Savings have risen to nearly $600 billion from nearly $0 in 2007. (You can verify this at the Bureau of Economic Analysis.)

- While the current government’s actions may create an inflationary environment, he is not forecasting any inflation at this time.

- When asked about China’s role in financing our debt, Ezrati likened the situation to a manufacturing company subsidizing a customer at a loss, only to gain when selling the end product. As long as China continues to run an export-oriented economy, then they have little choice but to finance US debt because of their reliance on the US for its economic base.

- When asked about drawing an analogy between Japan plight in the 1990s to the current U.S. situation, Ezrati cited that Japan’s government failed to acknowledge bad debt at the start (versus the mark-to-market requirements in the U.S.), that Japan’s sub-prime debt was non-paying (versus a 60% repayment rate in the U.S.), and there was not much of a corporate debt market in Japan (borrowers had to go to a bank for a loan). So overall, Ezrati indicated that the current situation in the U.S. does not compare to that of Japan’s a decade ago.

Wednesday, March 11, 2009

"Free Market Voice"

Working on a new project:

http://freemarketvoice.org

More info to come in the next few weeks after I get through the glut of work and teaching "to-dos" this week.

![]()

Monday, March 9, 2009

Paul Volcker on Bank vs. Hedge Fund Risk-Taking

Paul Volcker, former Federal Reserve Chairman regarding risk profiles of banks vs. hedge funds:

"Maybe we ought to have a two-tiered financial system," Mr. Volcker said at conference at New York University's Stern School of Business. Banks "should not be taking extraordinary risks in the marketplace."This is the basic premise of the financial system. Bank are inherently supposed to be risk-averse institutions, as discussed in this article about the US government's interference in the free market.

The rest of Mr. Volcker's comments are in the rest of the article on HedgeWorld.com.

Thursday, March 5, 2009

Recap: "Stimulus SmackDown: Can Deficit Spending Save the Economy?"

It wasn’t Ali-Frazier or even Hagler-Hearns, but the live debate hosted by University of California-Davis Institute of Government Affairs last night between Michele Boldrin of the CATO Institute and Washington Univeristy and J. Bradford DeLong of UC-Berkeley – “Stimulus SmackDown: Can Deficit Spending Save the Economy?” - proved entertaining nonetheless. As you might conjecture based on their institutional affiliations, DeLong argued in support of the recent U.S. economic stimulus bill while Boldrin vociferously argued against it.

Here’s a recap of the action:

Bradford DeLong

DeLong is a self-professed economic historian, and specifically denies that he is a macroeconomist. (That seemed to be a theme throughout the evening…) His approach to the economic stimulus package is a simple one, and one heard frequently throughout political circles – the patient is bleeding, therefore we need to apply a bandage. While that bandage will not heal the severed artery, we should focus on triage first and long-term solutions later.

Today’s economic environment now reaches far beyond a housing bubble – it’s clearly spilled over into other parts of the economy, so focusing solutions more broadly to include infrastructure projects, health care reform, and monetary allocations to individual states is an approach consistent with our economic challenges. It’s okay to increase the deficit now to achieve a surplus later. We should be spending more and taxing less in the short term to pull us out of today’s emergency.

DeLong argued that empirical studies show that when one industry gets motivated and decides to spend, it can turn an entire economy. In this case, the stimulus plan is a decision by society to spend and that “the government’s money is as good as anyone’s. It is a reasonable and intelligent thing to take this action on our own behalf.” That said, DeLong acquiesced that an economic stimulus package does not equate to long term economic growth, but continued to emphasize is argument on triage first, operation later.

DeLong supports the “Ackerlof’s approach” to taming the economy. (George Ackerlof won the 2001 Nobel Prize in Economics for his contributions to psychology in the marketplace and has recently written a new book – “Animal Spirits.”) DeLong also argued that the Swedish Banking Model deployed in the 1990’s is sound approach that should be considered in the United States.

His presentation was short and to the point – do something now and deal with the consequences once the economy is recovering. We are facing significant economic problems now, and something needs to be done immediately to stem the tide of ongoing negative economic trends.

Michele Boldrin

Boldrin is a general equilibrium economist, which means that he focuses on the microeconomic side of supply and demand – equilibrium models starting from individuals and firms, then aggregating into macroeconomic analysis (whereas macroeconomics tend to take an “top-down” aggregated approach to economics.) As Boldrin put it, macroeconomists “suffer from the aggregate.”

He likened the approach of economic stimulus to that of rock-climbing – rushing to decisions serves to detriment of the participant. The notion that “We have to do something!” will ultimately weaken the economy even further. “Even the Bush tax cuts - $400? They avoided the real economic problem.” The real problem lies in the financial markets and overall structural dynamics of the economy.

Boldrin focused two primary arguments against the stimulus package in its current form. First, he cited empirical evidence that show increases in public spending do not have a multiplier effect on the economy. That is, when government spends, the economy feels only the net effects of the primary spending – there is not downstream multiplier effect. In fact, he maintained that the Keynesian multiplier for government spending was perhaps less than 1. Several prominent economists share this perspective, including Robert Barro and Bob Hall and Susan Woodward. Of course, other leading economists such as Valerie Ramey and Christina and David Romer contest that the government multiplier is greater than 1. Shocking -economists don’t agree on something. (Christina Romer is the Chair of Obama’s Council of Economic Advisors, perhaps for good reason based on her research findings.)

Boldrin also showed correlation empirics from several of the G7 countries - France, Germany, Canada, Italy, and Japan – which all indicate that there is no correlation between public spending and Gross National Product for any of these countries. He also clearly stated that his issue is not with the general concept of government spending, but whether it is useful for economic stimulus. He cautioned the Obama administration on shrouding political aims under the guise of economic stimulus. Quick spending does not help the acute.

For example, what about increased health care spending that is included in the stimulus package? This is an industry currently with rising employment according to the January 2009 U.S. Bureau of Labor Statistics, so two outcomes will be evident from these spending increases. First, we’ll end up paying higher wages to the current labor market in the health care industry. Second the “hammer and nail guy” in Las Vegas will not benefit from the stimulus because he won’t become a nurse by year’s end. Yes, there are provisions for creating a health IT system, but relative to the other allocations in the stimulus plan, they account for a small part of the overall allocation to the health care stimulus line items.

In a related argument, Boldrin argued that focusing the economic stimulus on spurring demand for durable goods such as automobiles and housing (which generally require credit, and in turn, require fixing the credit market) will only increase employment in the production of that good in those industries – it does not create overall employment. (This is the general equilibrium economist showcasing his traits.) If we focus on stimulating demand in the industries hardest hit by the recession, we are going to be pushing for the purchase of SUVs and houses in Nevada. Isn’t that how we got here in the first place? (DeLong believes the labor is more flexible than Boldrin, even using the example of the person redoing his bathroom who was a janitor just two months ago. Labor mobility is a hotly debated topic among labor economists.)

The problem with increased spending now is that history shows that we do not decrease the spending later. There is never guarantee that these government programs will be cut later. “Pay-as-you-go” as is proposed is not the same as cutting spending and taxes in the longer term. “Pay-as-you-go” can simply mean increased taxes in the longer term to pay for these social programs now inserted into annual government expenditures.

Boldrin often took the debate away from the straight “Yea or Nay” on the economic stimulus package and focused his attention on the state of the U.S. financial system, again examining the effects of public spending on economic growth, illustrating the cases of Japan in the 1990s and Chile in the 1980s. Japan took the approach of fiscal spending for many years and created a “zombie state” in banking. Japan’s long-term economic growth struggles throughout the 1990s are well-documented. Alternately, the solutions of the Chilean banking crisis in the early 1980s focused on cleansing the banks and swiftly as possible. Boldrin supported taking the latter approach, and said that we need to purge the leadership of the banking sector - “keeping the same guys is a bad idea.” When credit crunch creates the problem, you need to start with the banks first.

With regard to the Swedish model introduced by DeLong, Boldrin agreed because Sweden exercised fiscal constraint in lowering taxes and spending – not the basis on the U.S. economic stimulus package.

Selected Audience Questions

“If there is true slack in the labor market (unused capacity), and we assume that the social cost of the infrastructure and other social programs included in the stimulus package equals long-term social benefit, doesn’t that mean that building a bridge or school now means getting that public works project at a bargain because spending more now means less spending later?"

DeLong : Agreed.

Boldrin: Yes, but we must mandate that when government costs rise now, they must be cut down the road and there is evidence in our economic and political history that these cuts do not occur.

Macroeconomics suffers from too many assumptions – flexible prices, labor and capital mobility, the efficient market hypothesis, rational expectations theory, perfect information, perfect competition, and many others. Isn’t basing policy decision on macroeconomic theory a flawed approach given the complexity of our economic environment?

Both DeLong and Boldrin agreed with this point. DeLong went on to say that the most relevant lectures he attended were that of Charles Kindleberger, who wrote “Manias, Panics, and Crashes,” which is consistent with his support of Ackerlof’s plan for the economy.

Boldrin went on to say that the New Keynesians (such as DeLong, Obama, and Christina Romer) suffer from the same problem. There is too much “master of the universe” – that Greenspan or Bernanke or the government can move some levers and we’ll all become rich. Economics is too complex to assume singular actions can move the economy. There are technology shocks, demand shocks, energy shocks, changes in productivity, and other exogenous effects that are constantly affecting the economy.

When did the Great Depression end and why?

DeLong used this question to further support the need for emergency spending. He stated that the Great Depression ended briefly in 1937 when the United States started to show signs of recovery in 1935 and 1936. Roosevelt ended many of the public works programs such as the WPA and the economy slipped back into negative territory – Delong felt that FDR released government intervention to soon. Then World War II arose and the increased war-time spending further bolstered the economy through even more government spending, and eventually pulled us back to stability in the mid-1940s. Using this logic, it’s very clear that government spending pulled the United States out of the Great Depression.

Final Takeaways

I attended the “Smackdown” expecting to side with Bradford DeLong based on his blog entries over recent weeks about the overall meltdown of the economy. I must admit, he’s done a good job hiding his Keynesian tendencies…

I was left with a statement from Boldrin that ultimately strengthened my viewpoint against the vastness of the stimulus package (Admittedly, I went into the event biased against the broad provisions included in the bill such as the health care and other social provisions…):

“What happens when we come back in six months with 12% unemployment and are having the same debate? Will the response be – ‘We have to do something!’?”

-------

[The entire debate was videotaped and should be available at www.iga.ucdavis.edu in the next day or so.]![]()

Wednesday, March 4, 2009

The "Housing Rescue" by the numbers

The Obama administration released the details of the housing rescue today, and the WSJ put together a nice "Fact Sheet" that I just reviewed.

Here's the money reward if you purchased a home you could not afford, or were a lender that eschewed the standard practice of lending to credit-worth people:

Servicers that modify loans according to the guidelines will receive an up-front fee of $1,000 for each modification, plus “pay for success” fees on still-performing loans of $1,000 per year.Here's what it means:

Homeowners who make their payments on time are eligible for up to $1,000 of principal reduction payments each year for up to five years.

- Borrowers will be given a $5000 as reward for paying their refinanced mortgages on time. The rest of us just get to continue living in the house we bought.

- Lenders will be given $6000 for modifying a loan that otherwise would have defaulted.

Using the mortgage calculator on BankRate.com, suppose a $300,000 mortgage balance paid over 25 years at 8% interest, which assumes the new interest rate after the initial 5-year period adjustment of a 30-year, 5-year ARM mortgage contract. The monthly payment comes to $2315/month (not including taxes, insurance, and other monthly fees included in the monthly housing payment.)

Now, assume that a refinanced rate of 4.5% for the life of the loan. The new monthly payment drops to $1667/month - a difference of $648/month, or $7778/year. Keep in mind that both the borrower and the lender can each earn $1000/year, reducing the lender's "loss" to $6778 and subsidizing about 5% of the borrowers total annual payments for the initial five-year period. I say "loss" because this is a net gain for the lender versus the borrower defaulting completely on the loan.

Here's the good news that I can see from this program. Will this make a difference for most people that aren’t able to make their mortgage payments at the $2315/month? What's the elasticity of the borrower's willingness or ability to pay based on the 27% reduction? I'm guessing that these borrowers that will refinance are likely to miss at least one payment each year, even at the lower modified monthly payment amount. So the offer becomes void (until Congress inserts some exception to the rule... "You get points for trying...)

It probably will make a difference for some people who have had their hours cut at work or have lost a part-time job that was supplementing income. But for rest, I suspect that making mortgage payments was likely a binary condition - either you're paying or you're not. And if you're not, the 27% reduction isn't going to enable you to make the payments.

What about paying people $5000 and to go into foreclosure instead? Those that can't pay won't, so instead of delaying the inevitable, fast-track the foreclosures, and let the market clear faster so we can get on with the recovery.

Tuesday, March 3, 2009

The United States, Collectivism & Radar Guns

As the market continues to unravel and the socialist agenda of the current political administration moves farther along its path, my source of solace has been the late, great Milton Friedman. "Uncle Milty," as he's known throughout economic circles, had much to say regarding socialism, the government's constraint on markets, and American business.

Socialism in the United States

Back in a 1975 interview hosted by Richard Heffner on "The Open Mind," Friedman stated that the natural order of mankind is movement toward socialism. Human nature pulls us toward group behavior and collectivism, and while well-intended, we often establish laws and regulations in haste whose end result rarely (if ever) meets their initial objectives. It's natural for people to look to a central authority to establish rules and guidelines designed to protect their interests and propagate desirable behavior. If a condition or situation arises that negatively affects a minority group (that is numerically, not racially per se...), the initial response is to say - "That's terrible - there ought to be a law."

(The interview referenced here was conducted in 1975. Discussion topics focused on individual freedoms and the inefficiency of strong government intervention to solve social and economic issues. Here's a link to the 30 minute interview.)

In economic and financial circles, Milton maintained that free markets and permitting individuals to pursue their own self-interests is the most efficient way for societies to operate. This is clearly results in a duplicitous state of being - we know that the pursuit of individual self-interest is more efficient means to maximizing outcomes, yet our human tendencies move us to collectivism and socialism. Most importantly, the implementation of regulatory burdens by our socialist self results in exactly the opposite of its intended effect. As Friedman illustrated, consider any social program introduced by government - minimum wage laws, protective tariffs, or welfare. In every case, these enacted social programs resulted in ultimately hurting the very minority groups they are intended to protect, and can be proven to have done so using the most rudimentary technical economic models.

The long term effects of continued regulations and government intervention will lead us to the path of socialism, and eventually tyranny and serfdom under the weight of self-imposed governance. Friedman shared the view of Friedrick Hayek, who authored "Road to Serfdom" earlier in the 20th century. Given these natural human tendencies, Friedman estimated that there was only a 15-35% chance that we, as Americans, had the posterity to avoid complete socialism by taking the proactive measures necessary to enable individual freedom and resist our natural tendencies for collectivism, a state that which would evolve to the condition of serfdom and tyranny.

Fortunately, as Friedman explained, there are two situations that support the maintenance and protection of a free society. The first is government's inability to operate efficiently. As Friedman put it - "you almost never spend other people's money as carefully as you spend your own." Individually, we can examine nearly every social program at the most cursory level and quickly see the massive waste involved with its implementation. The second is the American commitment to finding loopholes and to circumventing laws.

The Housing Market: A Textbook Case of Government Inefficiency

The Community Reinvestment Act was enacted in 1977 and designed to encourage depository institutions (banks) to meet the credit needs of the communities in which they operate, with credit including home mortgages. In 1992, then-President Clinton signed the Federal Housing Enterprises Financial Safety and Soundness Act of 1992 which eventually authorized and capitalized Fannie Mae to purchase mortgage loans granted by banks to credit-risky individuals as a means to expand home ownership opportunities to low- and moderate-income individuals. Sounds noble - enabling the financial market to provide credit and mortgages to individuals that they would normally reject under financial guidelines. But what were the long-term net results?

The banking institution is inherently risk averse. They have liquidity guidelines that require cash to be readily available to the depositors. Traditionally, banks required a 20% down payment for home purchases and approved only those individuals with credit-worthy histories. There are sophisticated, mature industries along the risk spectrum – Hedge Funds, Private Equity Funds, Venture Capitalists, and industry-specific investment funds and private investors. Banks are not part of this cohort.

When banks were coerced into participating in higher risk activities, their response was to dispense of these risky loans in the form of mortgage-backed securities (MBS) to those in the marketplace better poised to take higher risks with the objective of higher returns. Seeing a demand for these assets, the banks accommodated by increasing the supply of risking loans. The mortgage broker industry, including firms such as DiTech, Ameriquest, and Countrywide, saw an opportunity to facilitate these loans on behalf of the banks, providing an avenue to banks to increase the supply of these MBS to meet the increased demand. Eventually, as is clear now, we see that many of the high-risk borrowers are unable to repay the mortgage payments due, are moving into default, or are going into foreclosure. This is causing a major increase in the available housing supply and reducing the housing market's equilibrium price.

As prices continue to fall and interest rates adjust upwards, more and more high-risk individuals are either deciding not to make their mortgage payments in protest of their poor decision-making process to purchase an over-priced asset, or are simply unable to continue making mortgage payments at today's adjusted interest rates. Shocking revelation - those with poor credit don't pay their bills or live beyond their means. This adds to the housing supply, further exerting downward price pressure on homes. "Wait a minute," you say, "when prices fall, shouldn't that mean that more people should be able to afford a home, especially those in the low and moderate income brackets?" Yes, the should... But now that banks are restricting access to credit to meet more traditional criteria, even restricting credit access to those that meet traditional credit ratings such as a +700 FICO score and 20% down payment available. Lending levels have fallen drastically, and thus those especially in the low to moderate income bracket are unable to receive approval for home purchases because the market for high-risk MBS dissipated.

This case illustrates exactly what Friedman stated - the same rules and regulations designed to promote home ownership has worked to the ultimate detriment of those they were intended to help. The "greed of banks and Wall Street" didn't create the housing market crisis. These market players acted exactly as they should under the rules of game placed upon them by government regulation.

And what makes greed so bad in the first place (Gordan Gecko notwithstanding)? Even Uncle Milty favored greed in its pure sense. Ask Phil Donahue what he thought after this interview with Friedman.

Baseball, Apple Pie & Avoiding the Law

The second salvation that we have as Americans to avoid complete socialism lies in our burning desire to take mulligans and interpret 55 to mean 64 on the highway.

With the monetary allocations to the bank bailout initiatives, it's been a popular mandate to require that CEOs of banks receiving bailout funding may not receive a salary about $500,000. Even with the newly-imposed executive compensation limits, there's evidence of loopholes. Check out this story in the LA Times.

And what about the new tax plan designed to pay for nationalized health care by taxing those earning more than $250,000 per year? Check out this article from the Associated Press. The tax plan is designed to increase government revenues by taxing the "rich." The net result - the "rich" decide to work less and pay fewer taxes. It's better to make $249,999 than it is to earn $250,000. Only the government could invent such as system that would actually encourage Americans to work less. Why would someone opt to earn less than more? Because it's in his individual self-interest to do so. The net result in weighing higher taxes on the wealthy? Lower revenues - the exact opposite result from the original objective.

These simple cases highlight that regardless of the laws and regulations instituted under a socialist agenda, Americans will find a way around the regulations. However, it's vital to understand the long-term effects of placing these institutional burdens on an economy. Finding a loophole comes with a cost as time, legal counsel, and accounting fees to name a few. These transactional costs eat into the ability for individuals and the marketplace to act efficiently. Slowly the regulations erode the foundation of a free marketplace, only to have it crumble beneath itself under the weight of collectivism.

Life, Liberty & The Pursuit of Happiness

Economic freedom is difficult to achieve and maintain. That's why individuals throughout the course of history have died to enjoy and preserve freedom. That's why Cubans try to swim 90 miles to Florida. That's why we all recognize the image of Tiananmen Square from 20 years ago.

It's difficult to take personally responsibility for your actions and outcomes, and easy to blame the rules of game for your failures. But it's those failures that spawn new efforts and eventual gains. I'd rather have the choice of failing 1000 times than abetting the singular failure of our free market system in America. How about you?

Sunday, March 1, 2009

Milton Friedman on "The Open Mind"

In researching for an article under development, I found these outstanding video interviews with Milton Friedman, hosted by Richard Heffner on "The Open Mind." This was a television series started back in 1956. Both interviews are approximately 30 minutes long.

The first interview was conducted in 1975. Discussion topics focused on individual freedoms and the inefficiency of strong government intervention to solve social and economic issues:

http://www.youtube.com/watch?v=JfdRpyfEmBE&feature=related

Friedman went on to win his Nobel Prize in Economics in 1976. Heffner followed up in 1977 with the second part of the interview:

http://www.theopenmind.tv/tom/searcharchive_episode_output.asp?id=493![]()

Saturday, February 28, 2009

Milton Friedman on Phil Donahue (1979)

Heard this on the radio on Friday -

http://www.youtube.com/watch?v=RWsx1X8PV_A

This is the reason that Milton Friedman won a Nobel Prize in Economics. Taped in 1979, think about the parallels that we're hearing in today's economic and political activity.

Let's stop with the talk about redistributing wealth as a means to solve our our personal economic and social situations.![]()

Thursday, February 19, 2009

American Business

I sat in a Starbucks today in Fort Washington, PA, checking email between meetings while on the road. At the table next to me were with two gentleman and a woman. The woman was a sales rep for ice cream shop supplies - ice cream mixes, ice cream cones, yogurt, etc. One guy was the owner/operator and the other was the managing partner.

After the 20 minutes that I eavesdropped on the conversation, she took the order, filled out the paperwork, and set up the account. "Diane" was so professional from start to finish - I actually went out to the parking lot when she left to compliment her.

Here's the best part - while sitting there and watching the two guys talk about their new ice cream shop this Spring, sharing the floor plan with Diane, and oozing excitement about the new venture, it gave me a certain sense of comfort and faith in the American businessman.

Despite Washington D.C.'s best efforts to waste a trillion dollars, the stock market's obvious disdain for the current economic situation, and the constant negative media that bombards every hour, here are two guys sitting in Fort Washington, PA - completely oblivious and thinking of nothing but their ice cream shop in a Starbucks when it's 40 degrees and windy outside.

This is why America is great.![]()

Wednesday, February 18, 2009

Facebook Terms of Service

Logged into my Facebook account this morning to see:

Over the past few days, we have received a lot of feedback about the new terms we posted two weeks ago. Because of this response, we have decided to return to our previous Terms of Use while we resolve the issues that people have raised. For more information, visit the Facebook Blog.The changes from earlier this month had users worried that Facebook would use their information after canceling an account with them.

I give them credit - they do listen to their users. Though, it would seem that they should try to listen to users before implementing policies like this so they don't appear to be backtracking all the time.

Sunday, February 15, 2009

Resources for "The Elevator Pitch"

Students in my Entrepreneurship class are required to produce a 30-second "Elevator Pitch" audio file as part of a business plan assignment each term.

Came across a few resources for those looking for more tips and help on developing the pitch for your business venture:

- TechCrunch's community video project - "Elevator Pitches"

- Dan Primack's blog post on PEHub - "Hey Entrepreneurs: Want Some VC Pitching Practice?"

- Your Elevator Pitch - Couple of good articles/tips

- "The (Perfect) Elevator Pitch" - by Aileen Pincus on BusinessWeek.com

- "Perfecting Your Pitch, Part One: Assume Short Buildings" - by John Hoult at Fast Company.

Thursday, February 12, 2009

New Article posted in Seeking Alpha

In case you missed it, Seeking Alpha posted a recent article I authored:

http://seekingalpha.com/article/119580-can-we-expect-a-springtime-bounce-in-housing-prices

I usually re-post the articles here, but this one was a bit lengthy with lots of graphs, so in the interest of time, I'm simply linking to the article from here.

Enjoy!![]()

Tuesday, February 10, 2009

Geithner on Lending Levels

And switching over Timothy Geithner's speech this afternoon... He stated that the program proposed is to (paraphrasing) "insure that lending would be greater than without government intervention."

Read: We're putting money in the market so that we can spur lending and open the credit markets.

That's what I thought they were trying to do.![]()

Bernanke on Entrepreneurship

Watching Mr. Bernanke's testimony to the House of Representatives Budget Committee. He just said something very poignant (paraphrasing):

In1930s in US and more recently in Japan, the destabilization of the banking sector made it very difficult for entrepreneurs to get credit and very difficult to grow their business.What I see in this statement is that business will lead us out of the current economic environment - not the government. Focus on financial market stabilization and business what it's good at - innovate and advance on new opportunities.

That is all.

Friday, January 30, 2009

Secondary Market for Private Equity

Interesting post from Joanna Glanser at PEHUB about the number of private equity partnership shares trading hands. From the brief article:

The forecast released this week by secondary market maker NYPPEX predicts that sales of limited partner stakes in private equity partnerships will soar by 68% to $27 billion in 2009.This highlights the stratosphere of markets that can and should exist to enhance market efficiency - allows one owner take possession of an asset that another is no longer willing or able to hold. Fred Wilson touched on that during his panel discussion at a recent conference. Marketplaces such as SecondMarket should exist to provide an exchange mechanism.

Wednesday, January 28, 2009

Goodwill Accounting

Back in April, I outlined Yahoo's "goodwill" account to highlight how they were overpaying for acquisitions - other technology companies developing products that should have been developed in-house at Yahoo!.

Today, I say this link on Twitter which provides a list of companies whose "Goodwill" accounts exceed their current market capitalization. Most of the companies appears to by in the Consumer or Communications industry. Not sure what the implications are, but interesting nonetheless.![]()

Sunday, January 18, 2009

The Mortgage Market, Housing Market & Inflation

This week, the Mortgage Banker’s Association released the “good news” of mortgage rates falling and loan applications rising. But is it really?

The Mortgage Industry

From the mortgage industry, there’s applause when mortgage rates fall and loan applications rise. Considered healthy, innovative, and robust in 2003, the longer terms effects of this outlook are now evident.

At the annual American Economics Association conference in San Francisco this month, Karl Case presented his paper “How Housing Busts End: House Prices, User Cost and Rigidities During Down Cycles.” Two of the slides presented show some stark numbers from 2003 when interest rates and mortgage rates reached historical lows. First, look at the number of loan modifications (“Refinance Originations”) in 2003 compared to Purchase Originations:

This isn’t a criticism of the mortgage industry, just a simple observation based on their incentive programs. Measuring the health of the mortgage market based on loan applications and interest rates feels like gauging the health of an alcoholic who just bought his 14th round of drinks during 2 for 1 happy hour. Yes, he’s joyful at the time based on his criteria for happiness, but the long term effects are obvious. Fool me once shame on you. Fool me twice, shame on me.

With refinancing, a few more people may stay in their homes with the lower rates, but the risk profile of the American borrower has not changed in any structural way since 2003. America’s negative personal savings rate is well-documented. The objective to spur the housing market based on lowering interest rates is misguided. The evidence from 2003 shows that – lowering interest rates along with easing credit restrictions leads to housing price inflation.

The Housing Market

Historically, economic recessions are usually followed with a sharp decrease in housing starts. In 2002, the amount of available cheap money bolstered consumer demand for new homes, so builders naturally continued home starts where they normally would have pulled back.

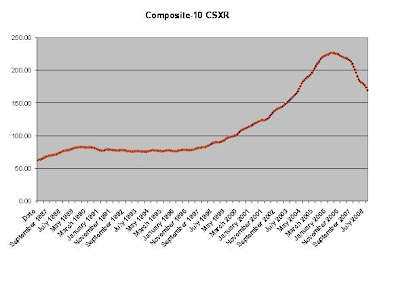

For existing home sales, home price trends jumped dramatically starting in the early 2000s and appear to be returning to their historical rates more recently according to the Case-Shiller Home Price Index:

This provides some evidence that the housing crisis is not a mortgage or liquidity crisis, but home price problem. As prices continue to fall to historical growth rate levels, the market will clear because markets work.

Inflation

When interest rates fall to a lower rate by increasing the Nominal Money Supply, keeping Real Money Demand levels constant, the net result is an increase in the inflation rate.

By definition:

Growth Rate of Nominal Money Supply – Growth Rate of Real Money Demand

While the latest economic data is showing an ease in the inflation rate, this is presumably a function of slower economic activity and the reason for the proposed economic stimulus packages in Washington.

M = Money Supply

V = Money Velocity (the rate at which money changes hands)

P = Price of the typical Transaction

T = Total # of Transactions

Rearrange the equation to show the net effects of an increase in Money Supply:

When Money Supply rises, holding Money Velocity and the Total Number of Transactions constant in the short term, the basic math shows that that Price of the Typical Transaction must rise (a.k.a. inflation). As the money supply increased from 2003-2008, the recent Federal Reserve’s cuts in the target interest definitely led to an increase in Money Supply. Inflation rates increased as money supply increased. With the recent economic downturn, the inflation rates dropped dramatically, matching with previous declines in the inflation rate that coincided with recessions (1981, 1991, & 2001):

The argument in many economic circles is that a little inflation would be good, just not too much. Greg Mankiw wrote about this back in December, suggesting that “moderate inflation would be desirable under the present circumstances. In particular, the overall level of prices a decade hence should be about 30 percent higher than the price level today.” (Be sure to read his comment to Paul Krugman…)

How does this relate to the Mortgage and Housing Market?

Some lending is good – economic activity will inevitably result with increased liquidity. Lending to everyone like we witnessed in 2003 is bad – it contributed to overly-inflated housing prices, credit defaults, and the current housing market situation. Every recession in economic history was followed by a boom of innovation, economic growth and prosperity. It’s understood that this longer view perspective doesn’t help the auto worker in Detroit or the single mom waitress in Miami. But let’s show some discipline and a little faith that the existence of business cycles indicates that it’s not necessary to solve the recessionary and housing market problems by Thursday with near-sighted patchwork.

(Author's note - This article was also published on Seeking Alpha on 1/19/09.)