This week, the Mortgage Banker’s Association released the “good news” of mortgage rates falling and loan applications rising. But is it really?

The Mortgage Industry

From the mortgage industry, there’s applause when mortgage rates fall and loan applications rise. Considered healthy, innovative, and robust in 2003, the longer terms effects of this outlook are now evident.

At the annual American Economics Association conference in San Francisco this month, Karl Case presented his paper “How Housing Busts End: House Prices, User Cost and Rigidities During Down Cycles.” Two of the slides presented show some stark numbers from 2003 when interest rates and mortgage rates reached historical lows. First, look at the number of loan modifications (“Refinance Originations”) in 2003 compared to Purchase Originations:

This isn’t a criticism of the mortgage industry, just a simple observation based on their incentive programs. Measuring the health of the mortgage market based on loan applications and interest rates feels like gauging the health of an alcoholic who just bought his 14th round of drinks during 2 for 1 happy hour. Yes, he’s joyful at the time based on his criteria for happiness, but the long term effects are obvious. Fool me once shame on you. Fool me twice, shame on me.

With refinancing, a few more people may stay in their homes with the lower rates, but the risk profile of the American borrower has not changed in any structural way since 2003. America’s negative personal savings rate is well-documented. The objective to spur the housing market based on lowering interest rates is misguided. The evidence from 2003 shows that – lowering interest rates along with easing credit restrictions leads to housing price inflation.

The Housing Market

Historically, economic recessions are usually followed with a sharp decrease in housing starts. In 2002, the amount of available cheap money bolstered consumer demand for new homes, so builders naturally continued home starts where they normally would have pulled back.

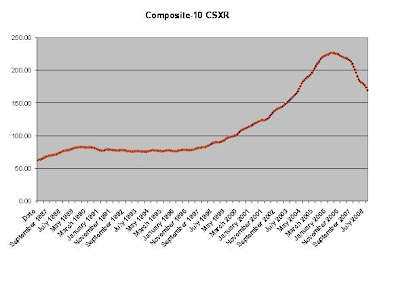

For existing home sales, home price trends jumped dramatically starting in the early 2000s and appear to be returning to their historical rates more recently according to the Case-Shiller Home Price Index:

This provides some evidence that the housing crisis is not a mortgage or liquidity crisis, but home price problem. As prices continue to fall to historical growth rate levels, the market will clear because markets work.

Inflation

When interest rates fall to a lower rate by increasing the Nominal Money Supply, keeping Real Money Demand levels constant, the net result is an increase in the inflation rate.

By definition:

Growth Rate of Nominal Money Supply – Growth Rate of Real Money Demand

While the latest economic data is showing an ease in the inflation rate, this is presumably a function of slower economic activity and the reason for the proposed economic stimulus packages in Washington.

M = Money Supply

V = Money Velocity (the rate at which money changes hands)

P = Price of the typical Transaction

T = Total # of Transactions

Rearrange the equation to show the net effects of an increase in Money Supply:

When Money Supply rises, holding Money Velocity and the Total Number of Transactions constant in the short term, the basic math shows that that Price of the Typical Transaction must rise (a.k.a. inflation). As the money supply increased from 2003-2008, the recent Federal Reserve’s cuts in the target interest definitely led to an increase in Money Supply. Inflation rates increased as money supply increased. With the recent economic downturn, the inflation rates dropped dramatically, matching with previous declines in the inflation rate that coincided with recessions (1981, 1991, & 2001):

The argument in many economic circles is that a little inflation would be good, just not too much. Greg Mankiw wrote about this back in December, suggesting that “moderate inflation would be desirable under the present circumstances. In particular, the overall level of prices a decade hence should be about 30 percent higher than the price level today.” (Be sure to read his comment to Paul Krugman…)

How does this relate to the Mortgage and Housing Market?

Some lending is good – economic activity will inevitably result with increased liquidity. Lending to everyone like we witnessed in 2003 is bad – it contributed to overly-inflated housing prices, credit defaults, and the current housing market situation. Every recession in economic history was followed by a boom of innovation, economic growth and prosperity. It’s understood that this longer view perspective doesn’t help the auto worker in Detroit or the single mom waitress in Miami. But let’s show some discipline and a little faith that the existence of business cycles indicates that it’s not necessary to solve the recessionary and housing market problems by Thursday with near-sighted patchwork.

(Author's note - This article was also published on Seeking Alpha on 1/19/09.)

No comments:

Post a Comment